Federal Tax Law Gambling

There is no getting away from the taxes if you win big at a Colorado casino or sportsbook. As in most states, you’ll need to pay income tax on that windfall. To balance this, you can deduct gambling losses — even if they come from a different form of gambling from your win. As you will see below, making your deductions “audit proof” requires some work.

Any other gambling winnings subject to federal income tax withholding. Additional, if your winnings are reported on Form W-2G, federal taxes are withheld at a flat rate of 25% (28% if you don’t give the payer your taxpayer ID number). Ababsolutumistockgamblinglosses The Tax Cuts and Jobs Act (TCJA) eliminates or scales back certain itemized deductions, including the deduction for miscellaneous expenses subject to the floor of 2 percent of adjusted gross income (AGI). However, deductions for certain other miscellaneous expenses have been spared. Native American tribes are required to use gambling revenue to provide for governmental operations, economic development, and the welfare of their members. Federal regulation of native American gaming was established under the Indian Gaming Regulatory Act of 1988. Under the provisions of that law, games are divided into three distinct categories. The federal government taxes gambling winnings at the highest rates allowed. So do the many states and even cities that impose income taxes on their residents. If you make enough money, in a high-tax state like California or New York, the top tax bracket is about 50 percent. For details, refer to IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, available on the IRS website. Other Legal Restrictions Many states and localities regulate gaming by nonprofits-for example, your nonprofit may be required to obtain a license.

With sports betting now in Colorado, many people will be hitting the 300x-their-bet threshold, which triggers a W2-G to be issued. A copy of this form will go to the IRS, making declaring it on your return mandatory. You’ll have to declare all wins, with the W2-G ensuring that bigger amounts are declared.

This page has you covered for state and local income taxes on gambling winnings in Colorado. There is also information on how the gambling businesses are taxed — and the good causes that Colorado gambling supports.

Federal income taxes on gambling wins in Colorado

You should declare every cent won in all forms of gambling to the IRS on your yearly tax returns. This includes wins from casino games, lottery windfalls, sports betting, horse racing bets or skill games, including DFS contests.

Many people are under the impression that you only need to declare those wins reported on a W2-G form. These are issued by casinos and sportsbooks for wins over a certain threshold. Here are some key examples:

- Slot Machines/Bingo Game: $1,200

- Keno Game: $1,500

- Poker Tournament: $5,000 (reduced by entry fee)

- Sports Bets/Pari-Mutuel Bets: $600 and 300x your stake

In some instances, the casinos will automatically withhold your taxes. This is required for betting wins over $5,000. You still need to report this on your tax return, though the tax will already be paid.

Offsetting losses from your federal tax return

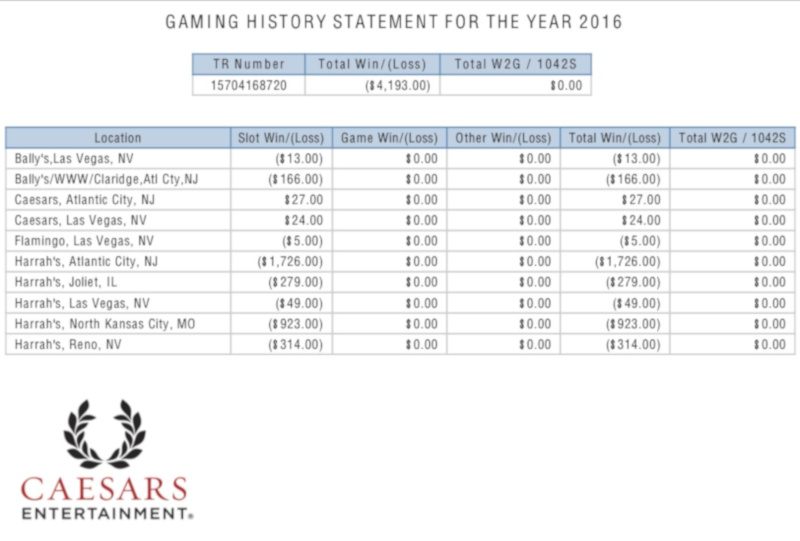

Simply collecting losing tickets or bet slips is not enough to offset your gambling losses. In the event of an audit, you will need to provide proof that all your wins are listed, and that all your losses were accurately recorded. This is hard to do, making rigorous record keeping very important.

A diary/log of your sessions, recording wins and losses, is a starting point. Where the game allows this, proof that you bought the tickets or participated in a game is the starting point for backup documents.

Keep in mind that you can only offset gambling losses against the tax you pay on gambling wins. The best outcome is that you cancel out any W2-G wins on your return.

Colorado state income tax and gambling winnings

Colorado has a flat state income tax of 4.63%. This replaced a tiered system, which had higher rates based on the amount you earned. You’ll need to have a similarly rigorous standard for reporting your wins/losses at the state level as you did at the federal level.

If you won money in another state — for example at a Las Vegas casino — then your state taxes will depend on what was already withheld. You won’t be double-taxed, as long as you can prove that this has already been paid in the state you won in.

You won’t be able to offset gambling losses against any other portion of your return than the gambling wins. As with the federal taxes, you are required to list (itemize) all losses and wins, not just those that triggered a W2-G to be issued.

How are the casinos, sportsbooks and OTB offices taxed?

It is not only individuals that pay tax on gambling profits in the Centennial State. The casinos at Central City, Black Hawk and Cripple Creek are subject to a gaming tax. The tribal casinos at Ute Mountain do not pay this.

The amount of taxes the casinos pay is based on gross profits (what they take in, minus what they pay to winners). This is tiered, with the marginal rate going up as the profits get bigger. Below, you will find the latest schedule of tax rates:

- Under $2 million: 0.25%

- $2 million to $5 million: 2%

- $5 million to $8 million: 9%

- $8 million to $10 million: 11%

- $10 million to $13 million: 16%

- $13 million+: 20%

Sportsbooks are taxed at a flat rate of 10% of gross profits. This includes both the retail and mobile sportsbooks. With only gambling, you’ll have a perfect record of your wins and losses — which make it easy for individuals to itemize for tax return purposes.

Pari-Mutuel betting is also taxed, though at a lower rate. While there is no greyhound racing in Colorado after the 2014 ban, it is still possible to bet on dog races via simulcast. This is taxed at 4.5%. By contrast, horse race bets are taxed at just 0.75%.

The lottery has a profit margin built in. This is for good causes, and so not subject to additional taxation. Wins need to be reported by individuals.

Gambling taxes in Colorado: Where the money goes

While some gambling tax money finds its way to the treasury via regular tax returns, the money collected via the lottery and casinos is earmarked for good causes. Here are some of the organizations and initiatives that benefit from gambling revenues in Colorado:

Federal Tax Law Gambling Statute Of Limitations

- Community colleges

- Colorado State Historical Fund

- Travel and Tourism Promotion Fund

- Gaming cities and counties

- Advanced Industries Acceleration Cash Fund

- Local Government Limited Gaming Impact Fund